Business Operations & Operating Results

Index Business Operations & Operating Results Fraud Prevention Operation

Fraud Prevention Operation

To monitor fraud transactions by merchants, NCCC has utilized prevention systems and statements with parameters preset and expert interpretation as a monitoring tool to identify any abnormal activities and proceed with investigations. For merchants who are verified violating the merchant contract, NCCC will take actions of education, warning, monitoring, or terminating the merchant contract according to the materialness of such violation, to supervise such merchants for improving. Also, as the credit card fraud reporting center, NCCC provides a fraud transaction information reporting platform that consolidates information from international associations and credit card institutions and establishes a joint defense system with an information-sharing mechanism to benefit the effective risk control in the domestic credit card transaction environment.

《Business Scope》

For NCCC merchants, NCCC implements effective monitoring and management system, consolidates, and sends fraud analysis to credit card institutions for effective information management, so as to jointly create a secure credit card transaction environment in Taiwan.

《Operating Results》

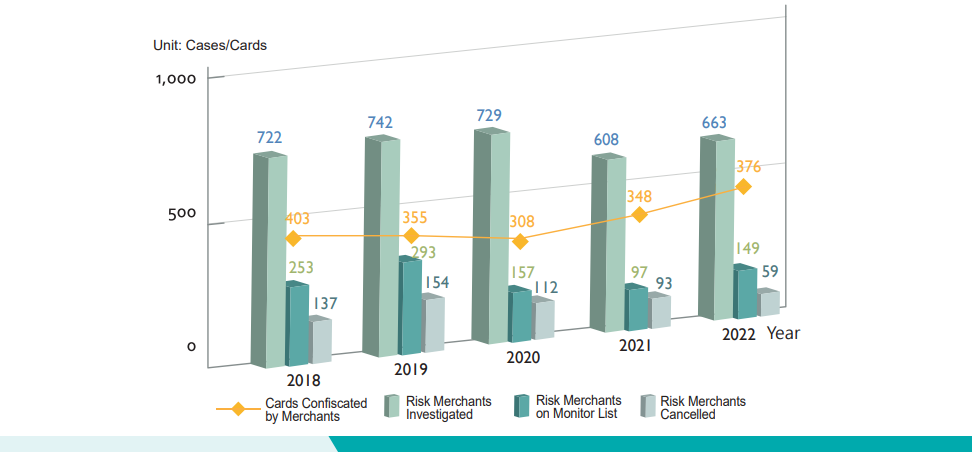

(I). Risk Merchant Control and Credit Card Confiscation

Number of Risk Merchants Investigated: The number of cases investigated in 2022 totaled 663, up 55 from 608 in 2021.

Number of Risk Merchants on Monitor List: The number of merchants put on the Monitor List in 2022 totaled 149, up 52 from 97 in 2021.

Number of Risk Merchants Cancelled: The number of merchants canceled totaled 59 in 2022, down 34 from 93 in 2021.

Number of Cards Confiscated by Merchants: The number of cards confiscated by merchants in 2022 totaled 376, up 28 from 348 in 2021.

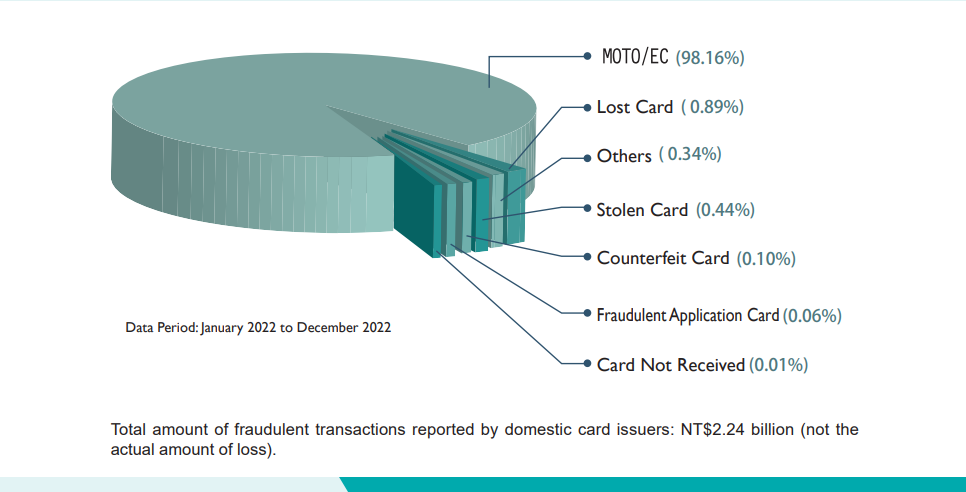

(II). Analysis on Fraud Transaction Categories Reported by Domestic Card Issuers

As the COVID-19 pandemic worldwide rampaged its way into 2022, non-cash transactions boomed continuously in Taiwan. In particular, online transactions soared due to the pandemic. As a result, the number of fraud transactions also increased significantly.

According to the statistics, the amount of fraud reported by domestic card issuers was NT$2.24 billion (not the actual amount of loss) in 2022, representing an increase of NT$278 million (+14.18%) as compared to NT$1.96 billion in 2021. As for the fraud transaction categories, “non-face-to-face transactions” remained the predominant category, accounting for 98.16% of the total reported fraud transaction amount. Meanwhile, fraud in other categories did not change much.

Remarks: (In accordance with the standards of International Card Associations’ Fraud Reporting Classification)

(1) Lost card: Card lost and found used fraudulently.

(2) Stolen card: Card stolen and used fraudulently.

(3) Card not received: New/renewed card intercepted during mail and used fraudulently.

(4) Fraudulent application card: Card applied and used fraudulently without authorization from the genuine cardholder.

(5) Counterfeit cards: Card counterfeited without authorization from the card issuer and used fraudulently.

(6) MOTO/EC: Non-face-to-face transactions made without authorization from the genuine cardholder.

(7) Others: Other types of fraud not listed above.