Business Operations & Operating Results

Index Business Operations & Operating Results Credit Card Authorization Switching and Settlement Operation

Credit Card Authorization Switching Center Operation

In response to the request from the Ministry of Finance for integrating and establishing a domestic authorization network for credit cards, NCCC and Financial Information Service Co. (FISC) jointly completed the system link in 2002. All the domestic credit card issuing and acquiring institutions may choose to link with either NCCC or FISC to switch and complete the transactions through the center of authorization system link. By doing so, we have achieved the competent authorities' policy goal of "Taiwan-issued international credit cards complete transaction authorization processing domestically when used in Taiwan." Meanwhile, for the transactions made outside of Taiwan by NCCC member-issued credit cards and the transactions made inside of Taiwan by foreign-issued credit cards acquired by NCCC members, NCCC acts on behalf of members to switch the authorization messages through connecting with the interface of the international credit card associations.

《Business Scope》

1. To handle inter-bank credit card authorization switching transactions through the hub of authorization system link for Taiwan-issued credit cards (including magnetic stripe card and chip card) that are used at domestic merchants (including brick-and-mortar, electronic commerce, mail order, and TV order); the transactions are processed via reading magnetic stripe, chip, or by an RFID reader, or by manual operation.

2. To process authorization transactions made at merchants in foreign countries by Taiwan-issued credit cards and debit cards, as well as transactions made at merchants in Taiwan by foreign-issued credit cards.

《Operating Results》

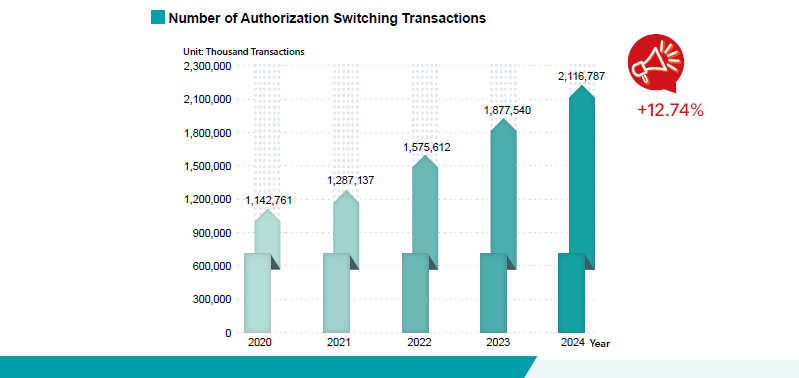

Number of Transactions:In 2024, NCCC processed 2,116,787 thousand authorization switching transactions, representing an increase of 12.74% as compared to 1,877,540 thousand in 2023. In recent years, it has cooperated with the competent authorities to continue to promote non-cash payment transactions, and expand the application scenario of small ticket transactions. The public have gradually become accustomed to the convenience of non-cash payment. The number of authorization transactions has witnessed a steady growth as shown in the figure below:

Domestic Credit Card Interchange & Settlement

After obtaining the competent authorities' approval, NCCC engages in processing domestic credit card interchange and settlement operations. NCCC handles the non-on-us transactions acquired by all acquiring institutions, consolidates and generates the settlement sum, and processes settlement funds collecting and sending through the "Central Bank of the Republic of China (Taiwan) Interbank Funds Transfer System." The business aims and objectives are as follows:

1. To develop domestic credit card interchange and settlement operating regulations in accordance with the policies.

2. To handle the inter-bank settlement of domestic credit card transactions to enhance transaction data security.

3. To complete the settlement in Taiwan for domestic transactions to increase operating efficiency.

《Business Scope》

The scope of domestic interchange and settlement processing includes credit cards and debit cards of Visa, Mastercard, and JCB. The number of participating institutions totaled 39.

《Operating Results》

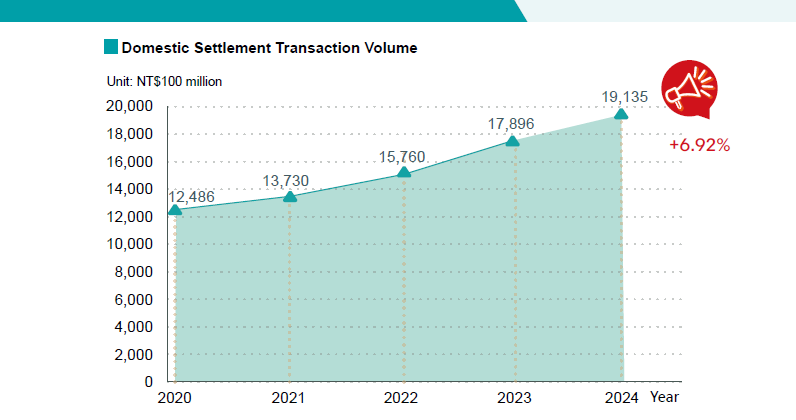

1. Transaction Volume: The domestic settlement transaction volume in 2024 totaled NT$1,913.5 billion. The amount represents an increase of 6.92% as compared to NT$1,789.6 billion in 2023 (as shown in the figure below):

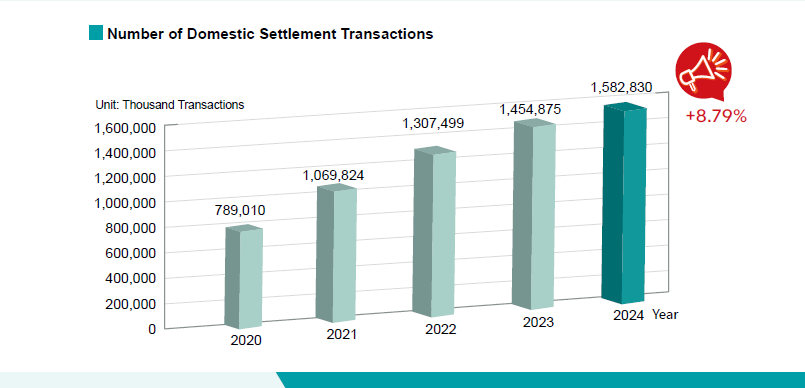

2. Number of Transactions: The number of domestic settlement transactions was 1,582,830 thousand in 2024, representing an increase of 8.79% as compared to 1,454,875 thousand in 2023. Please see the details in the figure below:

Domestic and International Transaction Interchange & Settlement for NCCC

Member-issued Credit and Debit Cards

NCCC is established as a member organization. To help members reduce operating costs, NCCC consolidates domestic and international transactions made by holders of NCCC member-issued credit cards and handles settlement operations for the members. Operation effectiveness can be summarized as follows:

1. To coordinate the establishment of a settlement system linking with the international credit card associations and processing transaction settlement for members.

2. To reduce members' operating costs and improve operating efficiency through centralized processing of transaction data.

3. To periodically provide business statistic data for members’ reference in decision-making.

《Business Scope》

The NCCC member-issued cards include credit card and debit card of Visa, Mastercard, and JCB. The number of participating institutions totaled 26.

《Operating Results》

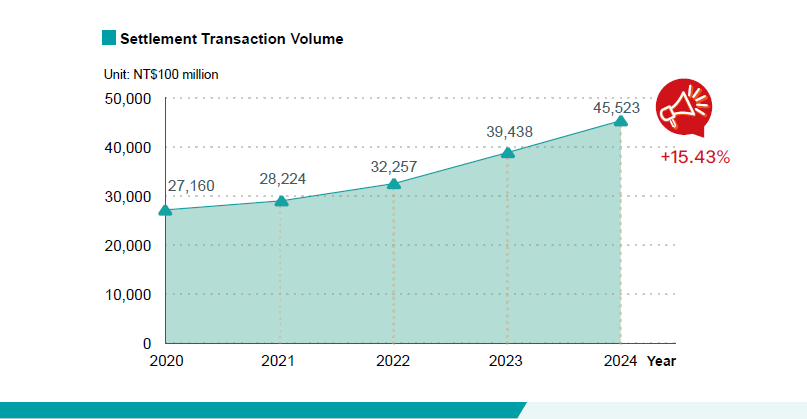

1. Transaction Volume: The settlement transaction volume in 2024 totaled NT$4,552.3 billion, representing an increase of 15.43% as compared to NT$3,943.8 billion in 2023, as shown in the figure below:

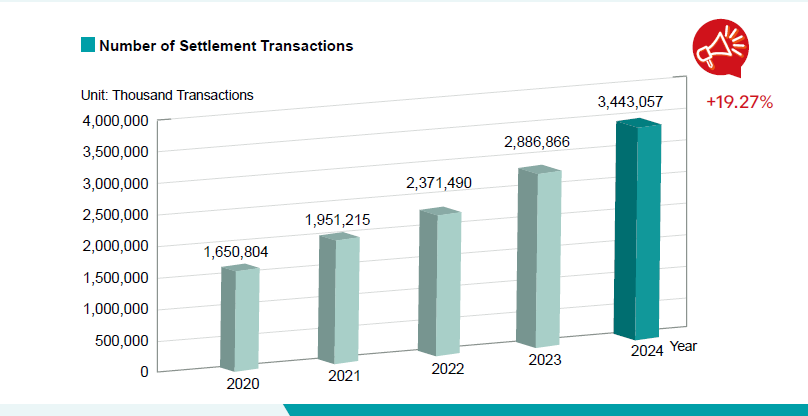

2. Number of Transactions: The number of transactions was 3,443,057 thousand in 2024, representing an increase of 19.27% as compared to 2,886,866 thousand in 2023. Please see the details in the figure below: