Business Operations & Operating Results

Index Business Operations & Operating Results NCCC Common Operating Platforms

1.Credit and Debit Cards Issuing Business of NCCC Members

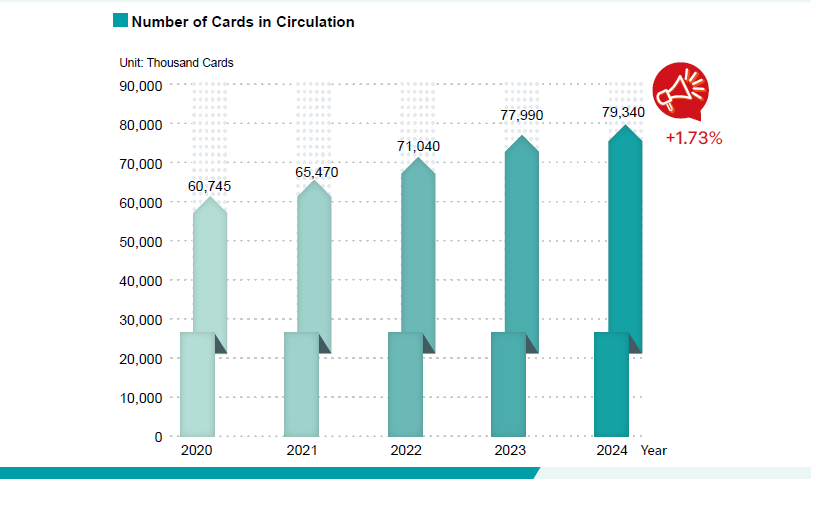

NCCC members issue Visa, Mastercard, and JCB cards. In recent years, the number of cards in circulation has been growing at a steady pace owing to the maturity of the financial environment for consumption in Taiwan, the rising demand of citizens, together with marketing and promotions made by the NCCC member institutions.

《Business Scope》

Visa, Mastercard, and JCB Card issued by NCCC members.

《Operating Results》

Number of Cards in Circulation: The number of credit and debit cards in circulation issued by NCCC members totaled 79,340 thousand in 2024, representing an annual growth rate of 1.73% as compared to 77,990 thousand in 2023, primarily because NCCC members continued to launch credit card products to expand consumers’ choices of use (as shown in the figure below). In addition, the number of debit cards in circulation also grew steadily (see the note for details).

【Cards in circulation refers to the number of total cards issued less number of total cards canceled.】

Note: The number of credit cards in circulation issued by NCCC members was 55,699 thousand and 55,700 thousand in 2024 and 2023.

The number of debit cards in circulation issued by NCCC members was 23,641 thousand and 22,290 thousand in 2024 and 2023.

2. Installment Payment Operating Platform

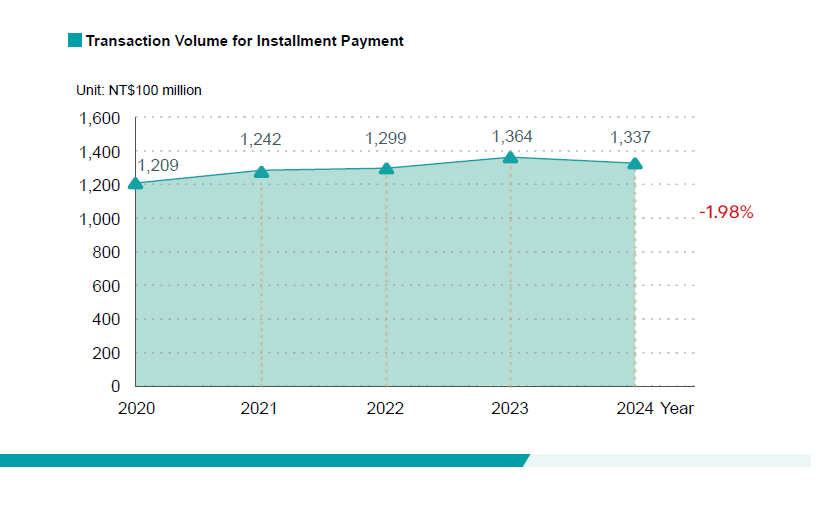

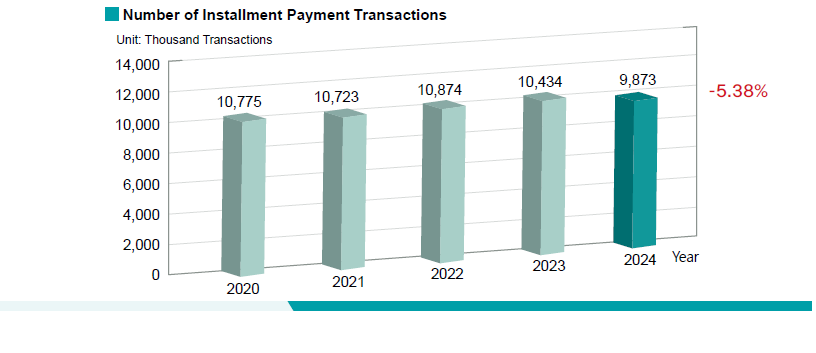

In response to the market demands, NCCC developed and established a common operating platform for both card issuers and their installment payment merchant partners in 2004. NCCC provides the instant online installment payment function to installment payment merchants who link to the network, allowing cardholders to pay the transaction amount of the consumption by making multiple installment payments for amounts recorded on credit card statements afterward.

《Business Scope》

The card issuers and merchants participated in the installment payment operating platform.

《Operating Results》

1. Transaction Volume: The transaction volume for installment payment amounted to NT$133.7 billion in 2024, representing a slight decrease of -1.98% as compared to NT$136.4 billion in 2023, as shown in the figure below:

2. Number of Transactions: The number of transactions for installment payment amounted to 9,873 thousand in 2024, representing a -5.38% decrease as compared to 10,434 thousand in 2023, as shown in the figure below:

3. Cardholders’ Online Transaction Authentication Service

To enhance security for online transactions and improve the service quality provided to cardholders by card issuers, NCCC established the “EMVCo 3DS—ACS (Access Control Server) Authentication Service for Online Transaction Security” that complies with specifications of international credit card associations such as EMVCo., Visa, Mastercard, and JCB and introduced the “Risk-Based Authentication (RBA)” function to provide online transaction authentication services with safety, convenience, and risk assessment to cardholders of card issuers. The service is equipped with comprehensive functions and has passed the audit conducted by the assessment institutions designated by the Payment Card Industry Security Standard Council (PCI SSC). In response to the business requirements of card issuers, NCCC also introduced network security authentication brands, including Visa Secure, Mastercard Identity Check, and JCB J/Secure that comply with EMV 3DS (3DS2.X) to provide online transaction with security and convenience through the parameter setting of the RBA system.

4. Credit Card Purchase Transaction Benefit Platform

In 2014, to meet the market demands, NCCC created a credit card purchase transaction benefit platform that is provided to card issuers and merchants for promotion and marketing events. When the credit card purchase transactions are made, the transactions will immediately be verified against the benefit terms and be exchanged for benefits via the platform and point of sale terminal. Such systems simplify the operations of merchants and invigorate marketing resources to increase the number of customers, along with transaction amounts.

《Business Scope》

The platform applies to the card issuers and merchants participated in the credit card purchase transaction benefit platform of NCCC.

《Operating Results》

In 2024, a total of 40 events were held, with a total number of 71 institutions and 13,067 merchants participated.

5. Credit Card ATM Cash Advance

NCCC established a credit card cash advance network and has partnered with the members engaging in acquiring operations to provide ATM (automatic teller machine) cash advance transaction services to the credit card holders. Cardholders may use Visa, Mastercard, JCB, and AE cards to carry out cash advance transactions by entering passwords, obtained from the card issuers in advance, at ATMs attached with an “NCCNET Plum Blossom” mark (as the figure below). The business scope includes the following:

1. Domestic ATM cash advance transaction service on the NCCC value-added application platform.

2. ATM transaction switching service for foreign Visa PLUS Card.

3. ATM transaction switching service for foreign Mastercard Cirrus Card.

6. Bonus Point Accumulation and Redemption Platform

NCCC provides a channel for bonus points exchange for card issuers. The participating merchants linked to the NCCNET POS network can provide an online redemption function that enables the cardholders to immediately redeem the bonus points accumulated to the transaction volume when paying for the transaction.

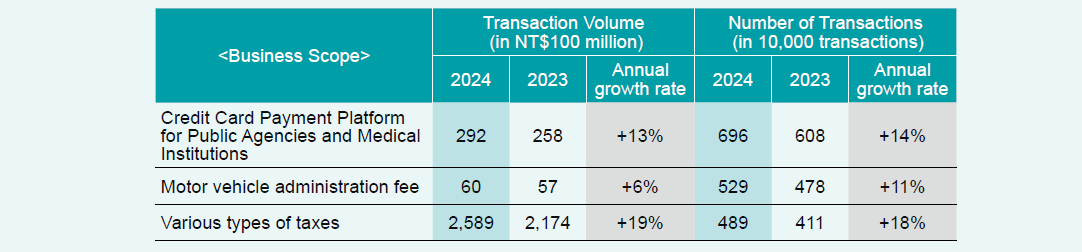

7. Government Fee Payment

To increase the penetration rate of e-payments and the credit card acceptance channels, NCCC established the "Credit Card Payment Platform for Public Agencies and Medical Institutions", allowing the public to pay public agencies related fees and bills over the counters by credit cards. The payment platform also applies to medical expenses at medical institutions (excluding items of plastic surgery, postnatal nursing, and physical

examination). Meanwhile, the platform system may link with the websites and Apps of public agencies and medical institutions, allowing the public to make payments at the websites and Apps of public agencies and medical institution.

To accord with the government policy of bringing greater convenience to citizens,and to provide incremental services and functions to the card issuers, NCCC has partnered with Chunghwa Telecom and motor vehicle administration bodies in providing fee payment services for citizens, where citizens can use credit cards to pay public service-related charges, motor vehicle administration fees, and taxes by obtaining the authorization code via phone voice operating system or the Internet. The business scope includes the following:

1. Motor vehicle administration fee: including traffic violation fine, fuel fee, handling fee, license plate fee, license plate number selection charge, etc.

2. Various types of taxes: including payments of Individual Consolidated Income Tax,assessed tax, as well as business tax, etc.

《Operating Results》

The number of transactions and transaction volume of government fee payment:

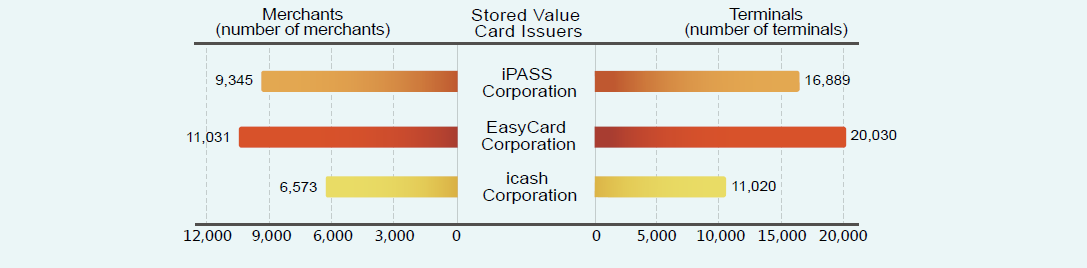

8. Stored Value Card (formerly known as Electronic Stored Value Card) Transaction Operation Platform

In 2016, to promote the convenience of small ticket service for citizens and accelerate the increase in the domestic electronic payment penetration rate, NCCC established the Stored Value Card (formerly known as Electronic Stored Value Card) Transaction Operation Platform in accordance with the "Regulations Governing Institutions Engaging In Credit Card Business," “The Act Governing Electronic Payment Institutions” (formerly known as "Act Governing Issuance of Electronic Stored Value Cards"), "Rules Governing the Business of Electronic Stored Value Card Issuers," and "Regulations Governing the Security of Electronic Stored Value Cards," and other operation specifications to integrate transactions of three domestic stored value cards (formerly known as electronic stored value cards), reducing the processing costs of small ticket transactions and fostering a favorable business environment.

《Business Scope》

Merchants that use the Stored Value Card (formerly known as Electronic Stored Value Card) Transaction Operation Platform of NCCC for stored value card (formerly known as electronic stored value card) transactions.

《Operating Results》

The number of merchants that use the Stored Value Card (formerly known as Electronic Stored Value Card) Transaction Operation Platform of NCCC and number of terminals:

9. Small Ticket Platform

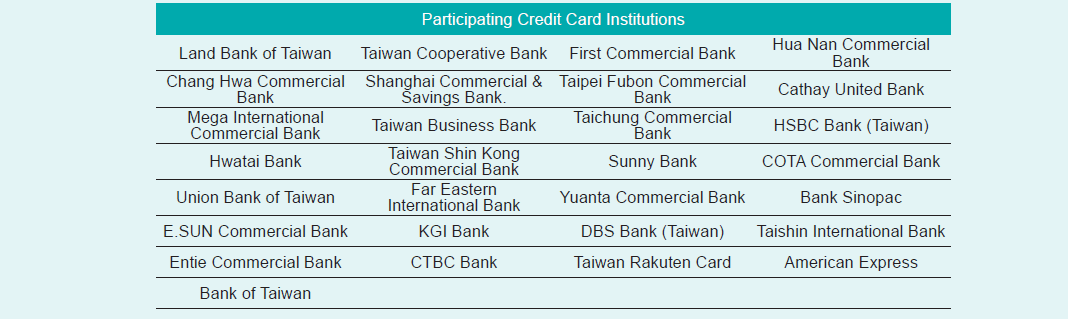

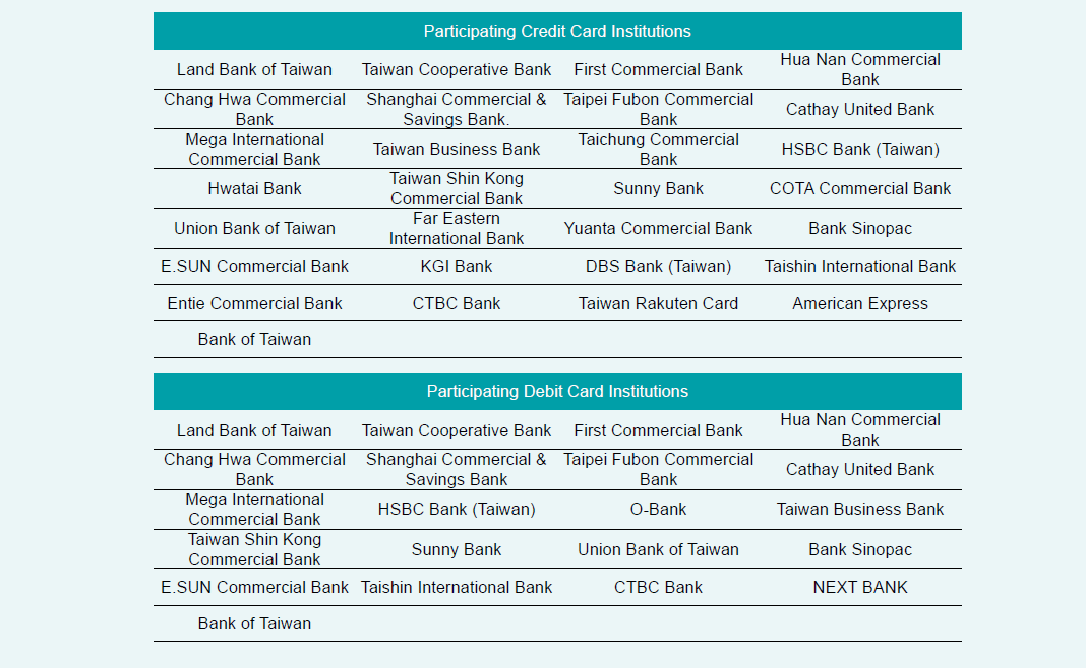

To provide credit card purchase service with rapid checkout, NCCC provides the “small ticket” function for merchants with low consumption price and high transaction volume (such as industries of convenience store/grocery store, Chinese/Western fast food, parking lot, handmade drinks, breakfast stall, bakery/confectionery, traditional market/ weekend market/night market, and vending machine). No signature is required for the credit card purchase made at the small ticket channels of NCCC with cards issued by card issuers signed up for the operation.

《Business Scope》

A total of 29 credit card issuers and a total of 21 debit card issuers signed up for the Small Ticket Platform of NCCC.

《Operating Results》

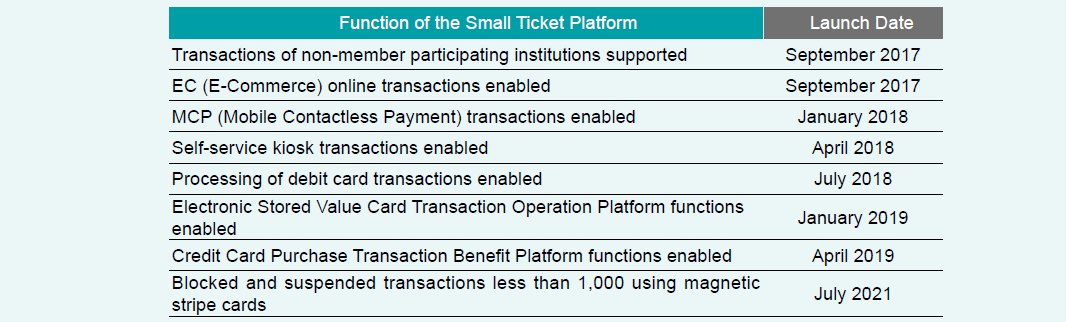

1. Launch dates for the functions of the small ticket platform:

2. Number of Transactions: The number of transactions was approximately 69.15 million in 2024, representing a growth of 33.21% as compared to 51.91 million in 2023.

3. Transaction Volume: The transaction volume amounted to approximately NT$17.73 billion in 2024, representing a growth of 29.80% as compared to NT$13.66 billion in 2023.

4. Number of merchants and channels using the Small Ticket Platform: There were approximately 13,073 merchants in total as of December 2024.

5. The reasons why the growth in transaction volumes and number of transactions for the Small Ticket Platform was higher in 2024 than before are as below:

(1) Increase in the number of merchants: As compared to 2023, the number of merchants participating the Small Ticket Platform grew from 11,183 to 13,073, representing an increase of 16.90%.

(2) Steady increase in market acceptance:Compared with 2023, the merchants participating the Small Ticket Platform increased by 16.90%, and the number of transactions increased by 29.80%,demonstrating a gradual change in the payment habits of consumers and gradual increase in the market’s acceptance of credit card payments.

10. Credit Card Holders Auxiliary Authentication Platform

To improve the operating efficiency for financial services, NCCC established the “Credit Card Holders Auxiliary Authentication Platform” in response to the government’s policy and in accordance with legal regulations, which allows electronic payment institutions and financial institutions to accept citizens using “credit cards” as an auxiliary cardholder authentication. When citizens register and open type 1 or type 2 electronic payment accounts online on the websites of electronic payment institutions, or open digital savings accounts, or apply for credit cards online with banks, or when a policyholder intends to verify his/her identity before insurance premium payment using a credit card, the verifying institutions would transmit the credit card information to NCCC’s authentication platform, and the card issuers would verify whether the credit card payment tools are used by the users, to achieve the digitalization and paperless purposes. In 2024, participants of this service platform included 10 electronic payment institutions, 35 card issuers, and 25 acquiring institutions, processing a total of 11.15 million transaction.

11. NCCC Tuition Connect Payment Platform

In order to facilitate card issuers in providing online payment services for tuition and miscellaneous fees of schools at all levels, NCCC provides the Tuition Payment Platform to facilitate the payment of tuition and miscellaneous fees with credit and debit cards. The platform offers functions including regular transactions and instant online installment payment. In 2024, a total of 23 card issuers and 3 intermediary banks were connected to the platform. The cumulative number of transactions through this platform amounted to approximately 80,000, with a transaction amount of approximately NT$900 million.

12. Merchant’s App Card-Binding Authentication Service

To comply with the government’s policy of strengthening card binding security mechanisms, NCCC launched the Merchant’s App Card-Binding Authentication Service. Acquiring institutions may use this system to provide their merchants with an auxiliary authentication mechanism to authenticate cardholders binding their credit cards to make purchases. When a customer binds his or her credit card on a merchant’s mobile App, the merchant will need to verify the mobile phone number of the customer with a one-time password (OTP). The customer’s mobile phone number and credit card number will then be transmitted through the acquiring institution to NCCC for authentication. The issuing institution will verify that the mobile phone number retained by the issuing institution is consistent with the mobile phone number provided by the customer, confirming that it is bound by the cardholder.